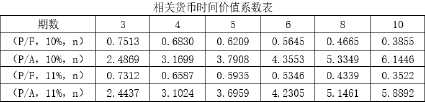

(1)Vb=1000×12%×(P/A,10%,10)+1000×(P/F,10%,10)=120×6.1446+1000×0.3855=1122.85(元)

(2)Vb=1000×12%×(P/A,10%,6)+1000×(P/F,10%,6)=120×4.3553+1000×0.5645=1087.14(元)此时债券的价值高于价格,因此值得购买。

(3)设内部收益率为R,1000×12%×(P/A,R,5)+1000×(P/F,R,5)=1070 当R=10%时,1000×12%×(P/A,10%,5)+1000×(P/F,10%,5)=120×3.7908+1000×0.6209=1075.80 当R=11%时,1000×12%×(P/A,11%,5)+1000×(P/F,11%,5)=120×3.6959+1000×0.5935=1037.01 运用内插法求得:R=(1070-1075.80)/(1037.01-1075.80)×(11%-10%)+10%=10.15%。