(1)银行借款资本成本=7.6%×(1-25%)=5.7%

(2)100×9%×(1-25%)×(P/A,K,5)+100×(P/F,K,5)=102×(1-3%)=98.94

当K=7%,100×9%×(1-25%)×(P/A,7%,5)+100×(P/F,7%,5)=6.75×4.1002+100×0.7130=98.98(元)

当K=8%,100×9%×(1-25%)×(P/A,8%,5)+100×(P/F,8%,5)=6.75×3.9927+100×0.6806=95.01(元)

(98.94-98.98)/(95.01-98.98)=(K-7%)/(8%-7%)

债券资本成本K=7.01%

(3)股利增长模型:

股票资本成本=0.35×(1+7%)/4.8+7%=7.80%+7%=14.80%

资本资产定价模型:

股票的资本成本=5.5%+1.1×(13.5%-5.5%)=5.5%+8.8%=14.3%

普通股平均成本=(14.80%+14.3%)/2=14.55%

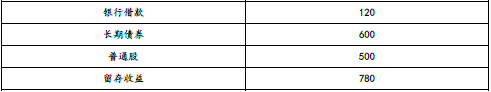

(4)资本总额=120+600+500+780=2000(万元)

5.7%×120/2000+7.01%×600/2000+14.55%×500/2000+14.55%×780/2000=11.76%。